Irs rental property depreciation calculator

If I select this TurboTax does not allow me to expense. NW IR-6526 Washington DC 20224.

Residential Rental Property Depreciation Calculation Depreciation Guru

Passenger automobiles as.

. How do I calculate depreciation on my rental property. We welcome your comments about this publication and suggestions for future editions. Calculate ROI return-on-investment before and after taxes.

Depreciation commences as soon as the property is placed in service or available to use as a rental. Stead of depreciation deductions for certain property and the additional rules for listed property. NW IR-6526 Washington DC 20224.

We simplify reporting your rental property depreciation to get you the biggest tax deduction. To figure out the depreciation on your rental property. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation.

Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. Section 179 deduction dollar limits. If you have more than three rental or royalty properties complete and attach as many Schedules E as are needed to separately list all of the properties.

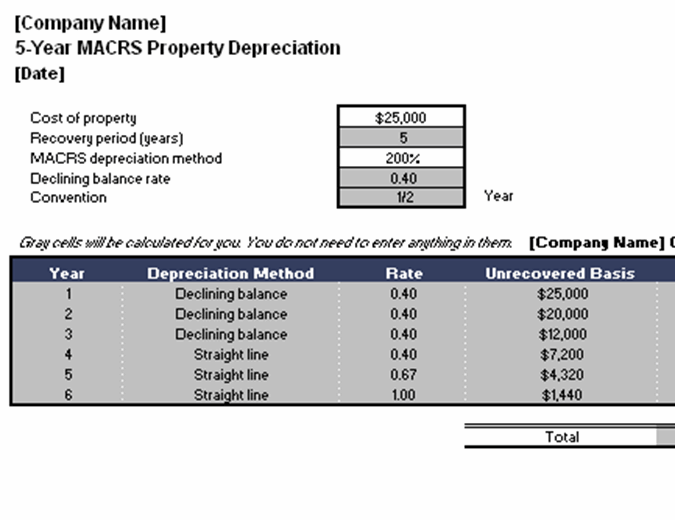

200 Declining Balance Method GDS. The depreciation methods discussed in this publi-cation generally do not apply to property placed in service before 1987. After the 265 years the property becomes completely depreciated.

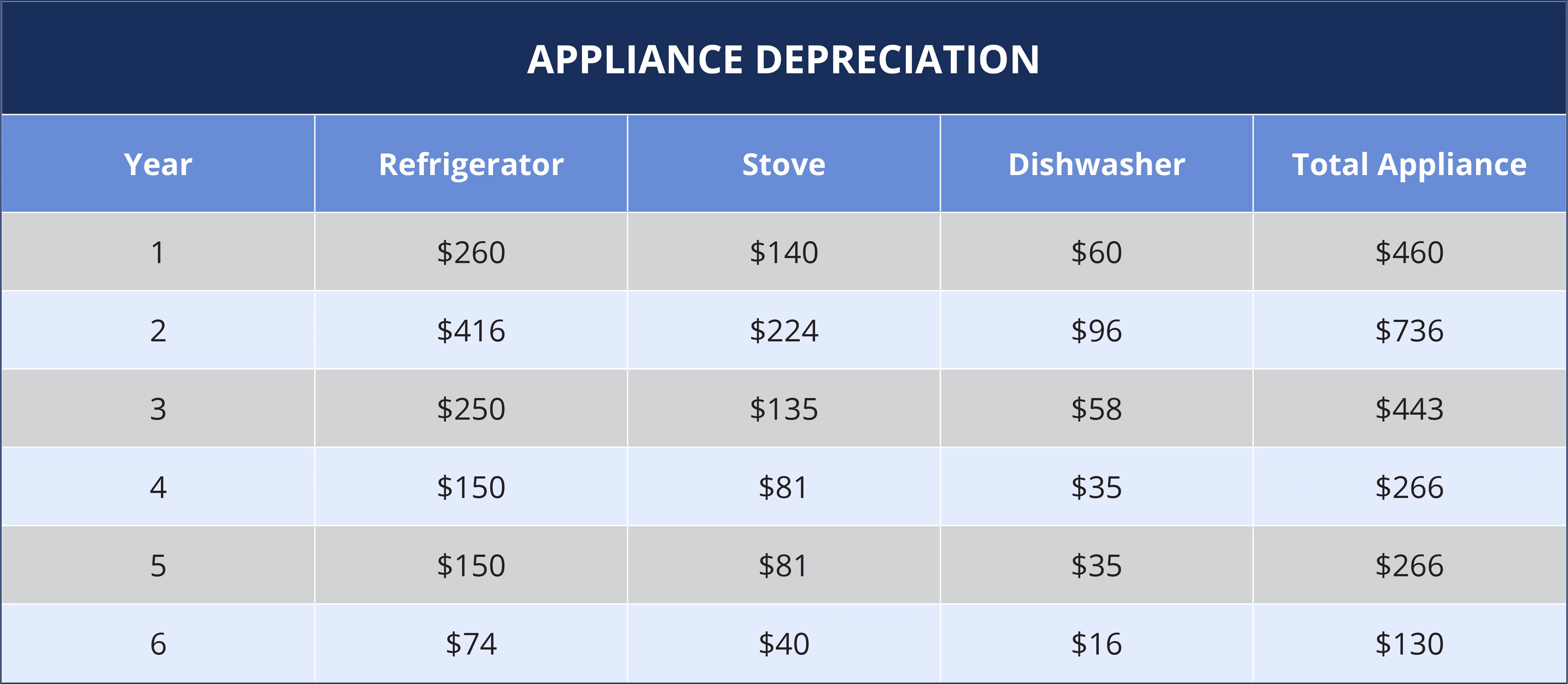

Depreciation recapture is assessed when the sale price of an asset. A rental property is usually on a 265 year depreciation schedule. After that if I select Appliances carpet furniture I am able to expense the entire 1349 this year.

I added the Water heater as asset and then selected Rental Real Estate Property. You ought to stick to the given steps. Free MACRS depreciation calculator with schedules.

Calculate depreciation for each property type based on the methods rates and useful lives specified by the IRS. Supports Qualified property vehicle maximums 100 bonus safe harbor rules. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

This is a coveted tax deduction because depreciation isnt a real cash expense. Allocate that cost to the different types of property included in your rental such as land buildings so on. TaxCaster tax calculator Tax Bracket calculator W-4 withholding calculator.

The IRS considers the useful life of a rental property to be 275 years so the amount of depreciation you can claim each year is your propertys value divided by 275. Catch-up depreciation is an adjustment to correct improper depreciation. If you did not when you sell your rental home the IRS requires that you recapture all allowable depreciation to be taxed ie.

You claimed more or less than the allowable depreciation on a depreciable asset. Calculating depreciation using macrs methods becomes easy with the ease of IRS depreciation calculator. Property depreciation for real estate related to MACRS.

For more information see Pub. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. Depreciation appliances rental property information is crucial for investors looking to take advantage of the many tax benefits of real estate investing.

The above estimates were calculated using IRS Publication 527 be sure to consult this guide. Claiming catch-up depreciation is a change in the accounting method. The deduction can be taken for the expected life of the property but it must be spread out over multiple years Note that the IRS says rental properties can depreciate over 275 years Keep in mind though that the value of the structure can depreciate but.

It and its new floor coverings and appliances have been depreciated for 2 tax years. I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis. We also guarantee our calculations are 100 accurate or well pay you any IRS penalties plus interest.

But what about the other assets. When you rent property to others you must report the rent as income on your taxes. Residential rental property is depreciated at a rate of 3636 each.

Be sure to enter the number of fair rental and personal-use days on line 2. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income.

Including the depreciation you did not deduct. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. List your total income expenses and depreciation for each rental.

Property used in a trade or business. IRS Section 121 allows people to exclude up to 250000 of the profits from the sale of their. List your total income expenses and depreciation for each rental property.

You didnt claim depreciation in prior years on a depreciable asset. So if you did not depreciate in past years you can still amend the last 3 years tax returns 2018 2017 and 2016 to claim that depreciation. They were being depreciated with a.

However I thought heater fell under 275 year depreciation category Residential Rental Real Estate. Determine your cost or other tax basis for the property. First of all you ought to take the value of the item or the property itself.

534 Depreciating Property Placed in Service Before 1987. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Listed property is any of the following.

Guidance and support for employee. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Adheres to IRS Pub.

We welcome your comments about this publication and your suggestions for future editions. If you have questions about how. When you complete a 1031 exchange you can sell the depreciated property without paying taxes and buy a new property with a brand new depreciation schedule.

I inherited a rental property that was being depreciated. Property used in a trade or business is considered ordinary income property to the extent of any gain that would have been treated as ordinary income because of depreciation had the property been sold. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Selling a home you live in is more tax beneficial than unloading a rental property for a profit. Many expenses can be deducted in the year you spend the money but depreciation is different. By convention most US.

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax

Macrs Depreciation Calculator Irs Publication 946

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Straight Line Double Declining

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Depreciation Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

How To Calculate Depreciation On Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

What The Irs Says About Cost Segregation Federal Income Tax Irs Income Tax

Rental Property Depreciation Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator Outlet 54 Off Www Ingeniovirtual Com

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate